RELIABILITY

PROVEN EXPERTISE TO WEATHER FINANCIAL VOLATILITY

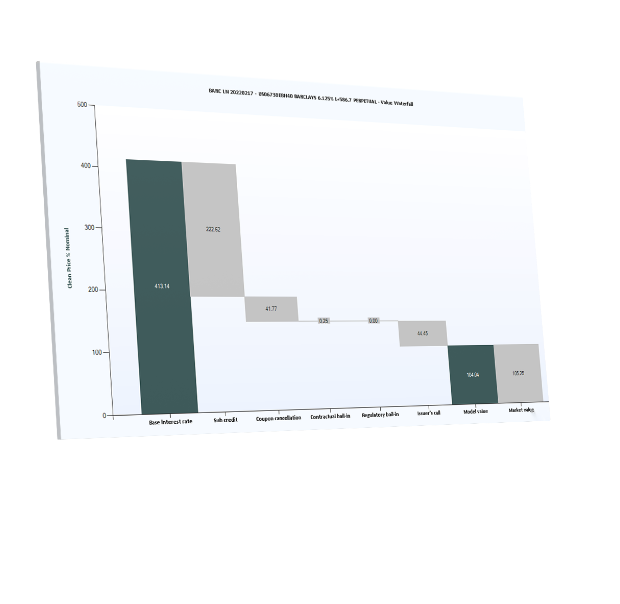

ACCURACY

ACCURATE PRICING MODELS DRIVE INSIGHTFUL DECISION-MAKING

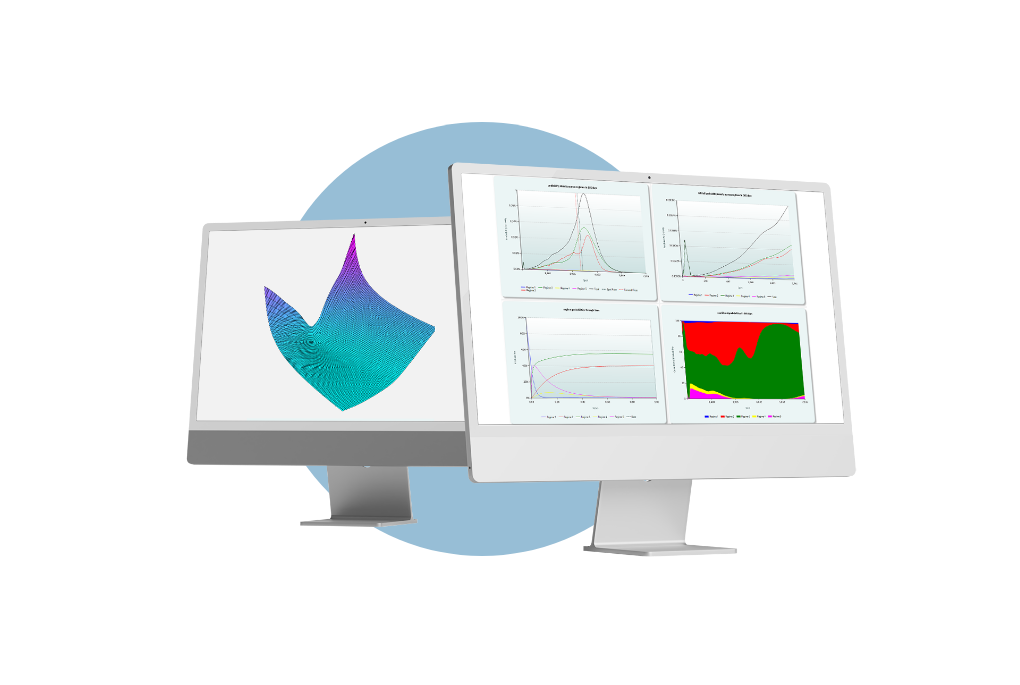

PERFORMANCE

FAST SUPERIOR NUMERICS ACHIEVE BEST-IN-CLASS PERFORMANCE

RESPONSIVENESS

UNPARALLELED, WORLD-CLASS CUSTOMER SUPPORT AND SERVICE

FLEXIBILITY

STATE OF THE ART APIS ALLOW EASY SYSTEM INTEGRATION

31 RUE FROIDEVAUX 75014 PARIS, FRANCE

31 RUE FROIDEVAUX 75014 PARIS, FRANCE

If you prefer send us an e-mail

If you prefer send us an e-mail